How Section 301 Tariffs on Chinese-Built or Operated Tankers Could Reshape US Oil Exports

- rorykevinproud

- May 15, 2025

- 2 min read

Updated: May 16, 2025

15 May 2025 AXSMarine

AXSMarine's analysis provides an updated breakdown of the global tanker fleet’s exposure to Section 301 tariffs at U.S. ports. However, it is important to note that this exposure profile could evolve further as the tariff discussions progress.

What’s at stake? A new look at fleet exposure

Currently, the analysis indicates the following distribution, though changes are expected based on the final tariff decisions:

~80% of tankers calling US Ports are not Chinese-built.

⚬ ~90% of these are not Chinese-operated (72% of total calls)

⚬ ~10% are Chinese-operated (Tier 2 exposure, ~8% of total calls)

~20% of tankers calling US Ports are Chinese-built.

⚬ ~90% of these are not Chinese-operated (72% of total calls)

⚬ ~10% are Chinese-operated (Tier 2 exposure, ~8% of total calls)

What this means

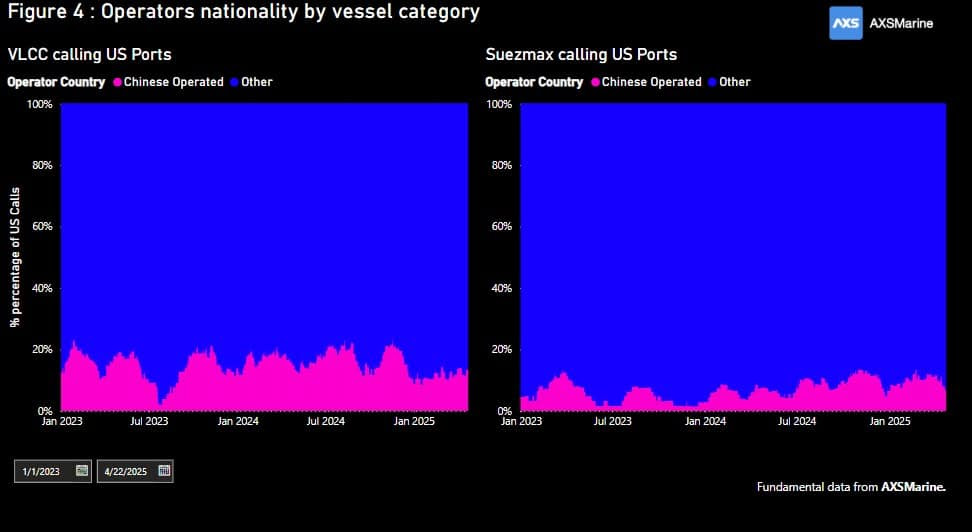

About 28% of the fleet faces potential tariff exposure, either under Tier 1 or Tier 2 categories. The financial impact is particularly significant for Dirty Tankers and MR2 Clean Tankers, with an increasing deployment of Chinese-operated vessels since early 2023.

However, under the new regime, vessels linked to international operators and falling under the MR2 category and below are exempt from the tonnage fee. As a result, some of these vessels may lead to the relocation of the operating companies to alternative markets, where the tariff impact can be mitigated, potentially shifting their operations outside China.

Understanding the Tariffs: Framework & Cost Drivers

Current latest Tarrif structure:

Chinese-operated vessels: $50/Net Ton (NT), applied both laden and in ballast

Chinese-built & Chinese-operated (Tier 1): $50/NT + $1.5 million flat fee

International operators using Chinese-built vessels (Tier 2):

⚬ Laden: $18/MT + $1.5 million flat fee (exemptions apply)

⚬ Ballast: $1.5 million flat fee only

Key Exemptions

⚬ Vessels under 55,000 DWT (below MR2 class)

⚬ Voyages under 2,000 nautical miles to the continental U.S. are exempt from the $18/MT fee.

The latter exemption primarily excludes Panamax Tankers transiting eastbound via the Panama Canal to ports south of Norfolk. In contrast, all westbound laden transits even starting from the Pacific side - Balboa (e.g., to U.S. West Coast ports) - exceed 2,000 nautical miles and will be subject to the $18/MT fee. However, the effect of the above will be muted.

There is some ambiguity regarding the applicability of the $1.5 million flat fee to all Chinese-built vessels. In light of the public comments and the guidance provided by the Section 301 Committee, the U.S. Trade Representative has decided not to impose any fee based on fleet composition at this time. Consequently, in our analysis, we have considered both scenarios—one incorporating the flat fee and one excluding it, since its not explicitly mentioned that flat fee is also replaced by the Tonnage fee as described in Annex II of USTR.

How we can help:

Submit your requirement - A member of the team will reach out within 24 hours.

Book a call with the team - Explore which of our 200+ data and analytics solutions align with your needs.

Click here to subscribe on LinkedIn: https://lnkd.in/exwPBCNG

Comments